NVIDIA Stock NVIDIA Corporation (NASDAQ: NVDA) continues to dominate the technology landscape, navigating both remarkable growth and significant challenges in 2025. From record-breaking financial performance to geopolitical headwinds, this analysis explores the company’s latest developments, market dynamics, and future trajectory.

NVIDIA Stock

Financial Performance and Growth

Record-Breaking Revenue and Profitability

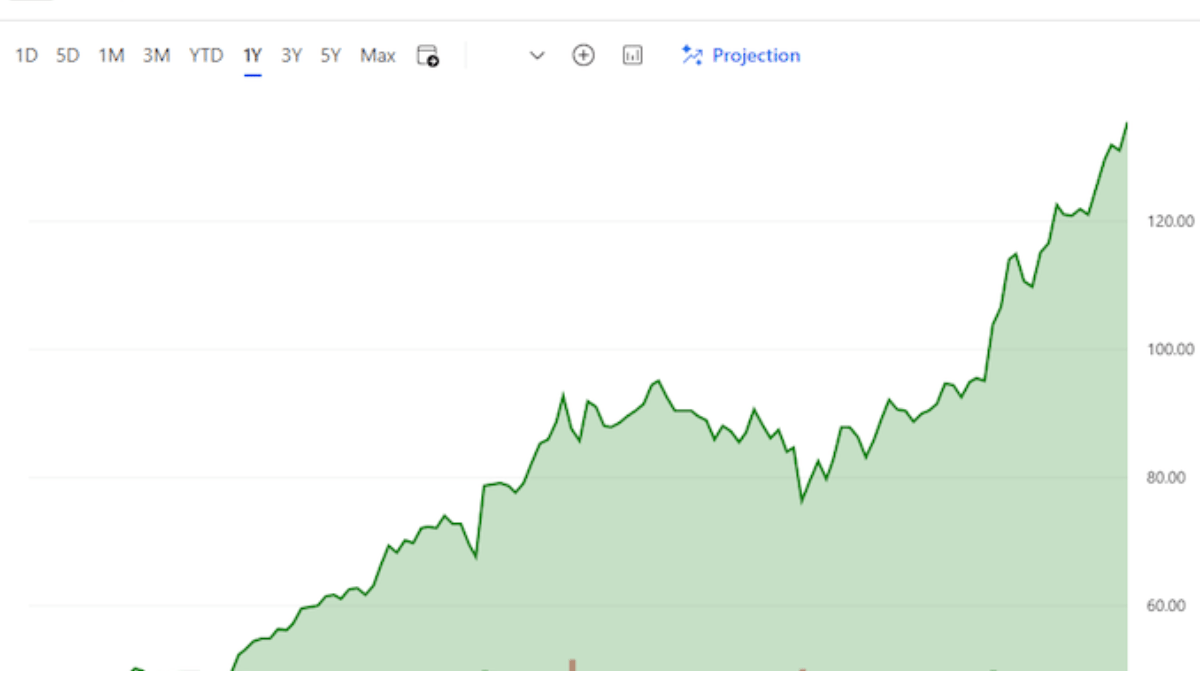

NVIDIA reported $130.5 billion in fiscal 2025 revenue, a 114% year-over-year increase, driven by unprecedented demand for its AI and data center solutions2. The fourth quarter alone saw $39.3 billion in revenue, up 78% from Q4 2024, with net income surging 80% to $22.1 billion2. This growth stems from the company’s leadership in AI-

Gross margins remained robust at 73.5% (non-GAAP), though slightly impacted by supply chain adjustments and R&D investments in new product lines like the Spectrum-X Ethernet for AI3. The company’s operating expenses

Quarterly Performance Trends

Q2 FY2025: Revenue hit $30.0 billion, up 122% YoY, with data center revenue contributing $26.3 billion

Q4 FY2025: Revenue climbed to $39.3 billion, marking a 12% sequential increase

This growth trajectory positions NVIDIA to capture an estimated 17% of the global AI server market by 2026, up from 10% in 20234.

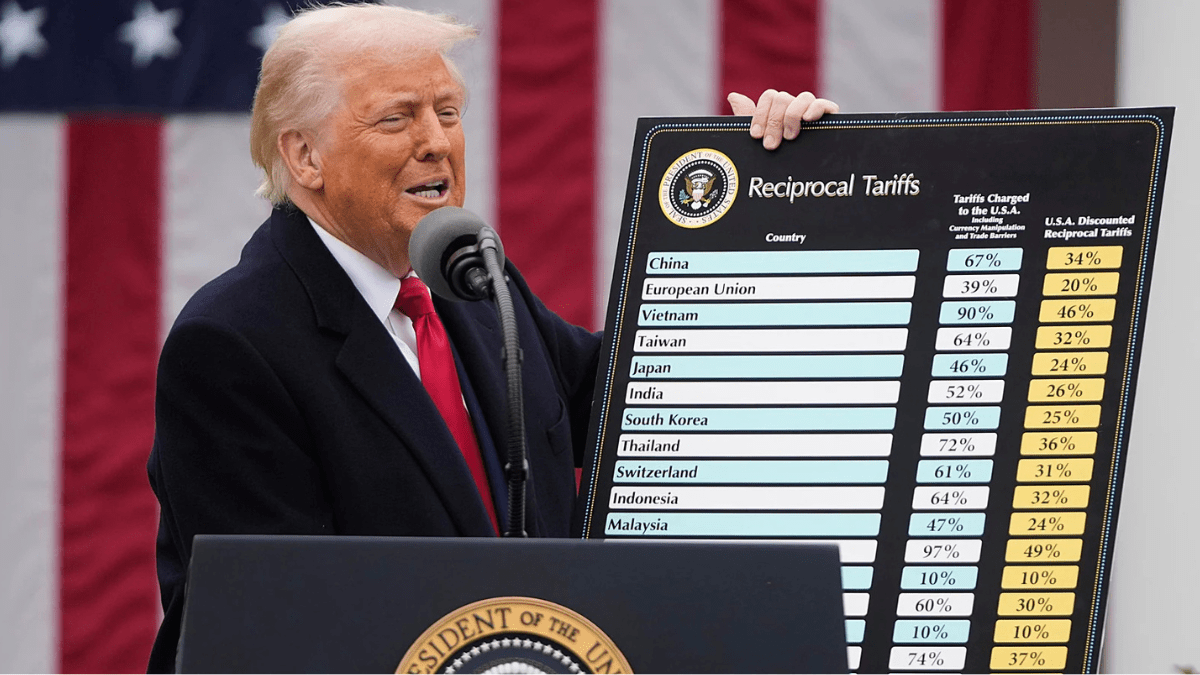

Impact of China Export Restrictions

$5.5 Billion Charge and Market Reactions

In April 2025, NVIDIA disclosed a $5.5 billion charge related to U.S. export restrictions on its H20 AI chips designed for the Chinese market1. The H20, a downgraded variant of NVIDIA’s flagship AI processors, became unsellable overnight due to new licensing requirements, forcing the company to write off inventory and purchase commitments1. This announcement triggered a 6.5% after-hours stock plunge and dragged down the broader tech sector, with the Nasdaq 100 Futures dropping 1.5%1.

Geopolitical Implications

The restrictions highlight the escalating U.S.-China tech rivalry, particularly in advanced semiconductors. Despite NVIDIA’s efforts to comply with earlier export controls, the H20’s designation under the new rules underscores the challenges of navigating geopolitical tensions. Competitors like Huawei and DeepSeek are capitalizing on this void, accelerating development of domestic AI chips in China.

Technological Innovations and Product Development

Blackwell Architecture and Liquid Cooling

NVIDIA’s Blackwell AI supercomputers entered mass production in Q1 2025, generating billions in initial

sales2. These systems integrate liquid-cooling technology, reducing data center power consumption by 40% while

supporting higher computational densities3. CEO Jensen Huang emphasized that 30% of new data centers will

adopt liquid cooling by 2026, positioning NVIDIA as a leader in energy-efficient AI infrastructure

Software Ecosystem Expansion

The company’s NVIDIA AI Enterprise software suite achieved significant adoption, contributing to a 71% YoY

increase in non-GAAP earnings per share3. This platform enables enterprises to deploy generative AI models across

industries, from healthcare diagnostics to autonomous vehicle training.

Stock Market Dynamics and Analyst Perspectives

Valuation Metrics and Investor Sentiment

NVIDIA’s stock trades at a 37.1x P/E ratio, significantly above the sector average of 10.6x, reflecting high growth

expectations4. Analysts project a 51.5% upside to shares, with price targets ranging from $152 to $200, driven by:

Dominance in AI training (80% market share)Expanding gross margins (75% in FY2025)

$50 billion share buyback program

However, the stock’s 34.1x price-to-book ratio signals caution among value investors, particularly given regulatory risks and competition4.

Post-Split Performance

Following a 10-for-1 stock split in June 2024, NVIDIA’s shares became more accessible to retail investors, contributing to a 278% surge in 2024 before the China-related dip

Future Outlook and Strategic Initiatives

Diversification Beyond GPUs

NVIDIA is expanding into ARM-based platforms through partnerships with Fujitsu, targeting low-power edge computing applications by 20273. Additionally, its Rubin GPU architecture, slated for 2026, promises a 30% performance boost over Blackwell, further solidifying its AI hardware leadership

Sustainability Commitments

The company aims to achieve carbon-neutral data center operations by 2030, leveraging liquid cooling and

renewable energy integrations. This aligns with global ESG trends, with 45% of Fortune 500 companies now

requiring sustainable AI solutions in procurement contracts.