Trading Tick: Learn everything about trading ticks! Understand tick size revisions in 2025, strategies like scalping & trend following, and how to profit from micro-price movements effectively

Trading Tick

In the fast-paced world of trading, understanding the concept of a “trading tick” is crucial for traders looking to capitalize on small price movements. A #trading tick represents the smallest possible price movement for a financial instrument, such as stocks, commodities, or indices. This blog explores what a trading tick is, how it works, and why it’s significant for day traders, scalpers, and high-frequency traders.

What is a #Trading Tick?

A #trading tick refers to the minimum price increment by which the price of a security can move up or down. For example:

- If a stock is priced at ₹100 with a tick size of ₹0.05, its price can move to ₹100.05 or ₹99.95 but not to ₹100.03.

- Tick sizes are regulated by exchanges like the NSE in India or the SEC in the U.S. to ensure orderly market movements.

How Does #Tick Trading Work?

#Tick trading involves leveraging these small price movements to execute rapid trades throughout the day. Here’s how it works:

- Analyzing Market Data: Traders use advanced tools like tick charts and market depth indicators to identify short-term trends and opportunities.

- Executing Rapid Trades: Using high-speed trading platforms, traders buy and sell securities within seconds or minutes to profit from incremental price changes.

- Managing Risks: Since frequent trades can lead to high transaction costs, risk management strategies like stop-loss orders are essential.

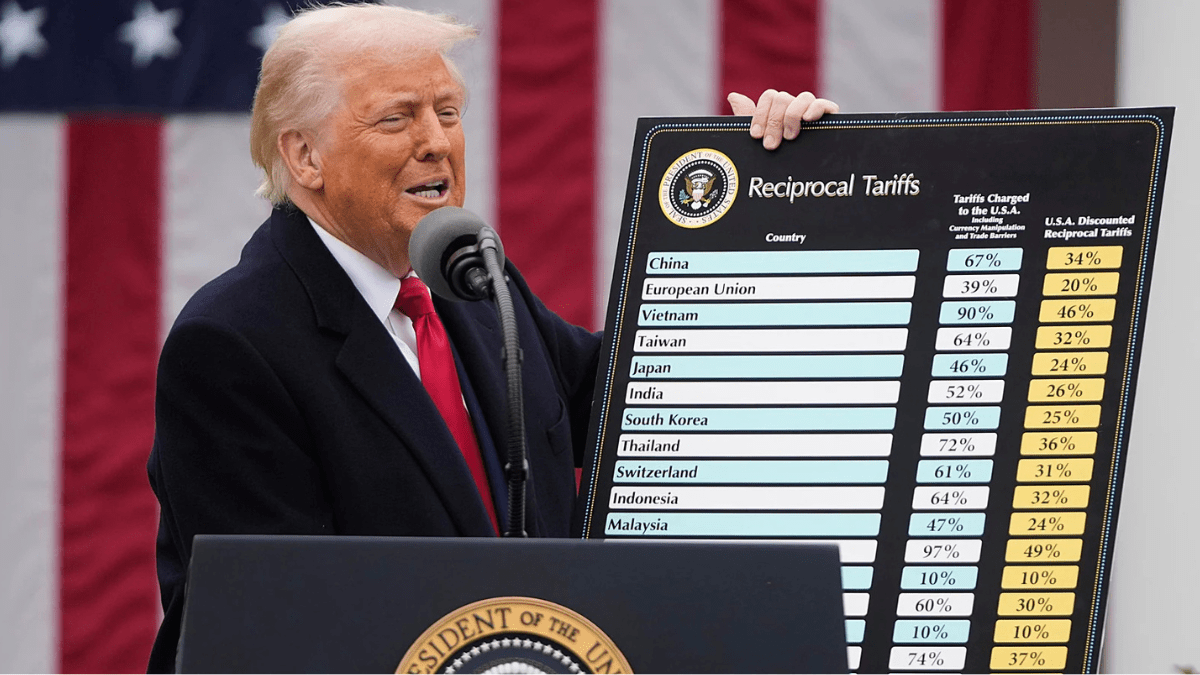

Tick Size Revisions in 2025

The National Stock Exchange (NSE) recently revised tick sizes for stocks and derivatives effective April 15, 2025:

- Stocks priced below ₹250 have a tick size of ₹0.01 (unchanged).

- Stocks priced above ₹5,000 now have a tick size of ₹0.50 to ₹5.00 based on their price bands810.

These changes aim to enhance liquidity and reduce excessive volatility in the market.

Advantages of #Tick Trading

- Quick Profits: By capitalizing on small price changes, traders can generate consistent returns throughout the day3.

- Improved Liquidity: #Tick trading adds liquidity to markets, benefiting all participants3.

- Precision in Execution: Tick charts provide real-time insights into market activity, enabling traders to make informed decisions4.

- Scalability Across Markets: The strategy works well across stocks, futures, options, and commodities3.

#Tick Trading Strategies

- Scalping: Profiting from small price movements by executing multiple trades within minutes or seconds7.

- Trend Following: Using tick charts to identify trends and ride them for short-term gains4.

- Volume Analysis: Examining volume data alongside tick charts to validate price movements4.

- Support and Resistance Levels: Identifying key levels using tick charts for precise entry and exit points4.

Risks of #Tick Trading

- High Transaction Costs: Frequent trades can lead to significant brokerage fees if not managed properly3.

- Leverage Decay: In leveraged trading strategies, compounding effects can erode profits over time9.

- Market Volatility: Rapid price changes can lead to unexpected losses without proper risk management.

Tools for #Tick Trading

Platforms like Upstox and Zerodha provide advanced features such as tick-by-tick data streams, depth charts (up to 30 levels), and real-time alerts to help traders execute precise strategies efficiently68.

Final Thoughts

#Tick trading offers immense potential for traders who can navigate its complexities with precision and speed. By understanding tick sizes, leveraging real-time data tools, and employing well-defined strategies, traders can capitalize on micro-price movements effectively.

- अप्रैल 2026 इंश्योरेंस से बदलेंगे डिपॉजिट इंश्योरेंस नियम ग्राहकों पर क्या असर पड़ेगा? DICGC का नया रिस्क-बेस्ड प्रीमियम मॉडल!

- भारत में गोल्ड ETF में 98% की जबरदस्त उछाल दुनिया भर में लोग इस डिजिटल सोने’ में लगा रहे पैसा!

- अंकिता भंडारी हत्याकांड महापंचायत में सरकार से सवाल, CBI जांच के लिए माता-पिता से FIR क्यों नहीं कराई गई?

- दिल्ली न्यूज दिल्ली में स्कूलों और संसद को बम धमकी अफजल गुरु के नाम पर दिल्ली बनेगा खालिस्तान’ का खतरनाक मंसूबा!

- बजट 2026 किसानों की बड़ी उम्मीदें – वित्त मंत्री निर्मला सीतारमण से क्या मांग कर रहे हैं Annadata? जानें पूरा डिटेल!

- सोना-चांदी में आज का धमाका एक दिन में गोल्ड ₹7795 और सिल्वर ₹10730 महंगा क्यों हो रही इतनी तेजी? जानें पूरा कारण

- सामाजिक सुरक्षा योजना भारत बजट से पहले मोदी सरकार की बड़ी राहत अटल पेंशन योजना को 2031 तक बढ़ाया अनौपचारिक क्षेत्र के करोड़ों मजदूरों को मिलेगा फायदा!

- IPL 2026 शेड्यूल में देरी BCCI ने RCB और RR को बेंगलुरु जयपुर होम मैचों के लिए दी डेडलाइन जानें पूरा मामला!