Seatrium Share Price Explore Seatrium’s share price trends in 2025. Learn about its performance, growth strategies, and future outlook in the offshore, marine, and energy sectors.

Seatrium Share Price 2025

#Seatrium Limited (SGX: 5E2), a leading player in the global offshore, marine, and energy industries, has been a focus of investor attention in 2025. With its share price showing steady movement and promising growth potential, this blog dives into its current performance, future outlook, and factors influencing its valuation.

Current Share Price of Seatrium Limited

As of April 14, 2025, Seatrium Limited is trading at $1.76 per share, marking a 1.15% increase from the previous trading session. Over the last four weeks, the stock has gained 16.98%, while its year-over-year growth stands at 12.82%2.

Key Metrics

- Market Cap: $5.69 billion1.

- Beta: 0.85 (lower volatility compared to market average)7.

- 52-Week Range: $1.21–$2.8036.

Seatrium Stock Forecast for 2025

Analysts and models provide mixed projections for Seatrium’s stock price:

- Short-Term Target: $1.71 by the end of Q2 20252.

- Consensus Target: $2.787 (+60.2% upside potential)6.

- Long-Term Risks: Some forecasts predict a drop to $0.3199 (-73%) due to external factors like competition and operational costs4.

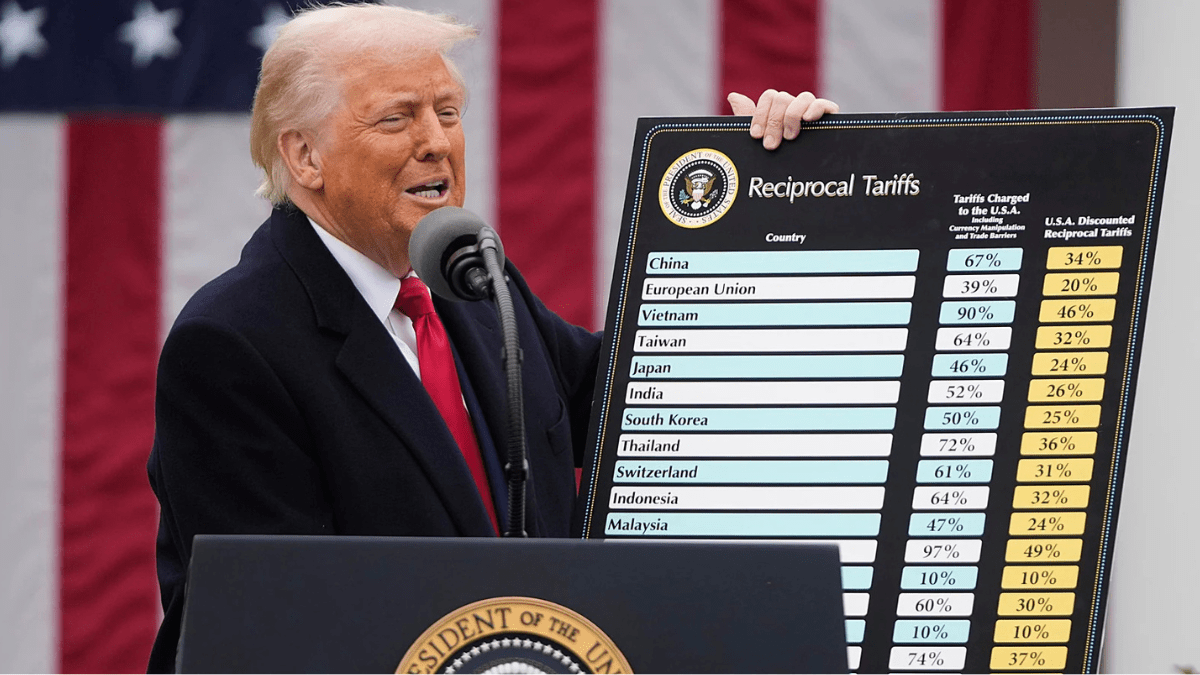

Factors Driving Seatrium’s Share Price Movement

Positive Catalysts

- Strong Orderbook and Strategic Partnerships: Seatrium’s focus on renewable energy projects and offshore oil & gas assets positions it for long-term growth56.

- Global Energy Transition: Increasing demand for sustainable solutions boosts market sentiment toward companies like Seatrium7.

- Analyst Ratings: Major firms like DBS Research and OCBC Investment have issued “Buy” ratings with targets as high as $36.

Challenges

- Low Margins: Operating margin of 1.47% and profit margins of 1.70% indicate high competition and operational costs7.

- Volatility Risks: While the stock has shown steady growth, external factors like macroeconomic trends could impact performance47.

Is Seatrium Stock a Good Investment?

Reasons to Buy

- Promising upside potential based on analyst targets (+60%)6.

- Strong position in offshore energy markets with a growing focus on renewables56.

- Lower volatility compared to market averages (Beta = 0.85)7.

Reasons to Be Cautious

- Mixed financial performance with low profit margins7.

- Divergent forecasts, including significant downside risks (-73%)4.

Final Thoughts

Seatrium Limited’s share price in 2025 reflects both opportunities and risks for investors. While analysts project significant upside potential driven by strong fundamentals and favorable industry trends, challenges like low margins and competitive pressures cannot be ignored. Investors should weigh these factors carefully before making investment decisions.

This blog post is optimized with keywords such as Seatrium share price, offshore energy stocks, and SGX stock forecast to ensure it ranks well on search engines for readers seeking detailed insights into this stock.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult a financial advisor before investing in stocks!