Alab Stock: Discover the latest updates on ALAB stock in 2025. Learn about its current price, market trends, forecasts, and insider activity. Is Astera Labs Inc. a good investment? Find out here!

ALAB Stock 2025: A Detailed Analysis and Forecast

Astera Labs Inc. (NASDAQ: ALAB) is making waves in the stock market, especially in 2025. Known for its semiconductor-based connectivity solutions, the company has seen both bullish and bearish trends this year. If you’re considering investing in ALAB stock, this blog post will provide you with all the insights, forecasts, and risks associated with it.

Current Performance of #ALAB Stock

As of April 2025, ALAB stock is trading at $60.13, significantly below its 52-week high of $147.39 but above its low of $36.2216. Despite recent volatility, analysts predict a potential upside for the stock in the coming months.

ALAB Stock Forecast for 2025

Analysts have mixed opinions on the future of #ALAB stock:

- Short-Term Forecast: The average price target for May 2025 is $94.46, representing a potential increase of 58% from its current price5.

- Year-End Forecast: By December 2025, ALAB’s price is expected to reach an average of $101.01, with high estimates of $124.91 and low estimates of $77.111.

- Long-Term Potential: Analysts forecast that ALAB could hit $216.77 by 2030 and continue to grow significantly in subsequent decades1.

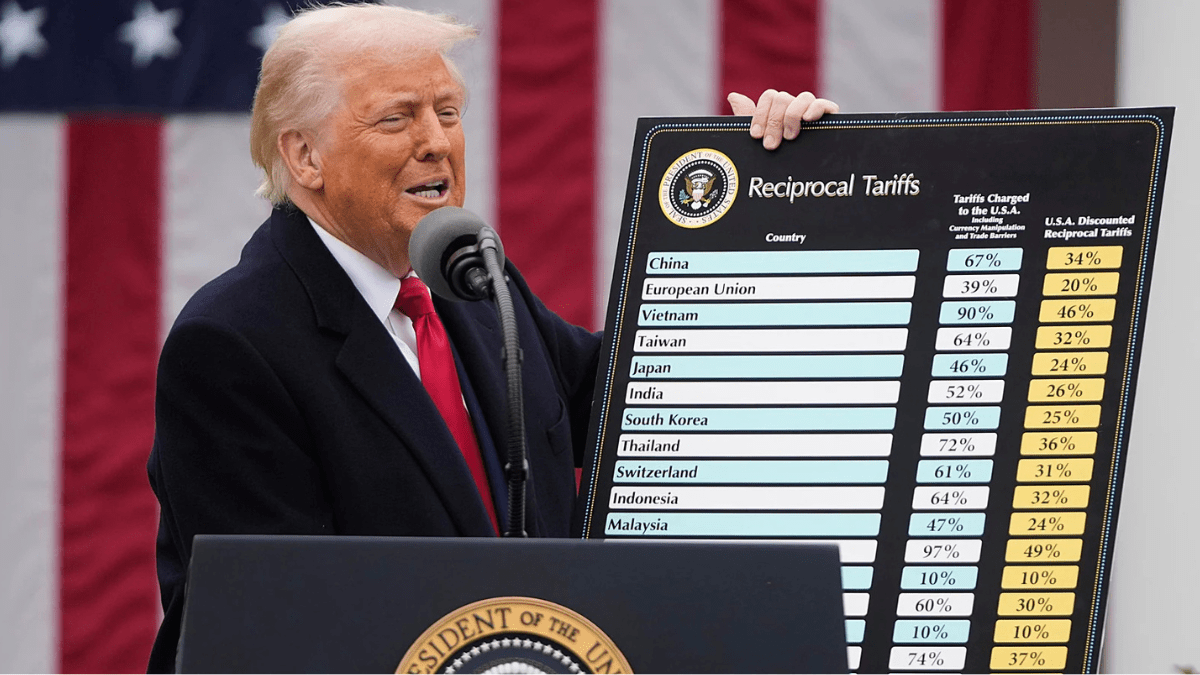

Why Has #ALAB Stock Been Volatile in 2025?

Several factors have contributed to ALAB’s fluctuating performance this year:

- Insider Selling: CFO Michael Tate sold over 125,800 shares at an average price of $82.53 earlier this year, unsettling investors2.

- Downgrades: Morgan Stanley downgraded the stock from “Overweight” to “Equal Weight,” citing overvaluation concerns2.

- Market Sentiment: The semiconductor sector has faced bearish sentiment in 2025 due to broader economic uncertainties and supply chain challenges25.

Is #ALAB Stock a Good Investment?

Bullish Indicators

- Analysts predict a potential upside of up to 67.98% by the end of 202515.

- The stock is trading at a significant discount compared to its long-term forecast, making it an attractive option for long-term investors15.

Bearish Risks

- Market sentiment remains bearish, with a Fear & Greed Index score of 39 (Fear)5.

- Short-term forecasts indicate potential declines due to volatility and insider selling pressures35.

Key Metrics for Investors

| Metric | Value |

|---|---|

| Current Price | $60.13 |

| Year-End Target | $101.01 |

| High Estimate (2025) | $124.91 |

| Low Estimate (2025) | $77.11 |

| Market Cap | $9.75B |

| 52-Week Range | $36.22 – $147.39 |

Final Thoughts

ALAB stock presents both opportunities and risks for investors in 2025. While its long-term growth potential is undeniable, short-term volatility may deter risk-averse investors. If you’re considering adding ALAB to your portfolio, ensure you weigh the risks against its promising forecasts.

This blog post is optimized with keywords like ALAB stock, Astera Labs Inc., and stock forecast to help readers find relevant information easily. Stay updated with market trends to make informed investment decisions!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult a financial advisor before making investment decisions.