Nysearca Soxl: Discover everything about SOXL stock in 2025! Learn about its performance, price forecasts, risks, and tips for trading this high-volatility leveraged semiconductor ETF effectively.

SOXL Stock 2025: Performance, Risks, and Investment Insights

The Direxion Daily Semiconductor Bull 3X Shares ETF (NYSEARCA: SOXL) has become a popular choice for aggressive investors seeking leveraged exposure to the semiconductor sector. As a 3x leveraged ETF, SOXL aims to deliver three times the daily performance of the ICE Semiconductor Index. This blog explores its current performance, forecasts for 2025, and the risks and opportunities it presents.

What is SOXL?

SOXL is a highly volatile leveraged ETF designed for short-term trading. It amplifies daily movements in the semiconductor sector by 300%, making it suitable for experienced investors looking to capitalize on short-term trends.

Key Features

- Expense Ratio: 0.76%.

- Assets Under Management (AUM): $12 billion.

- Dividend Yield: 0.27%.

- Underlying Index: ICE Semiconductor Index, which includes companies like NVIDIA, AMD, and Texas Instruments.

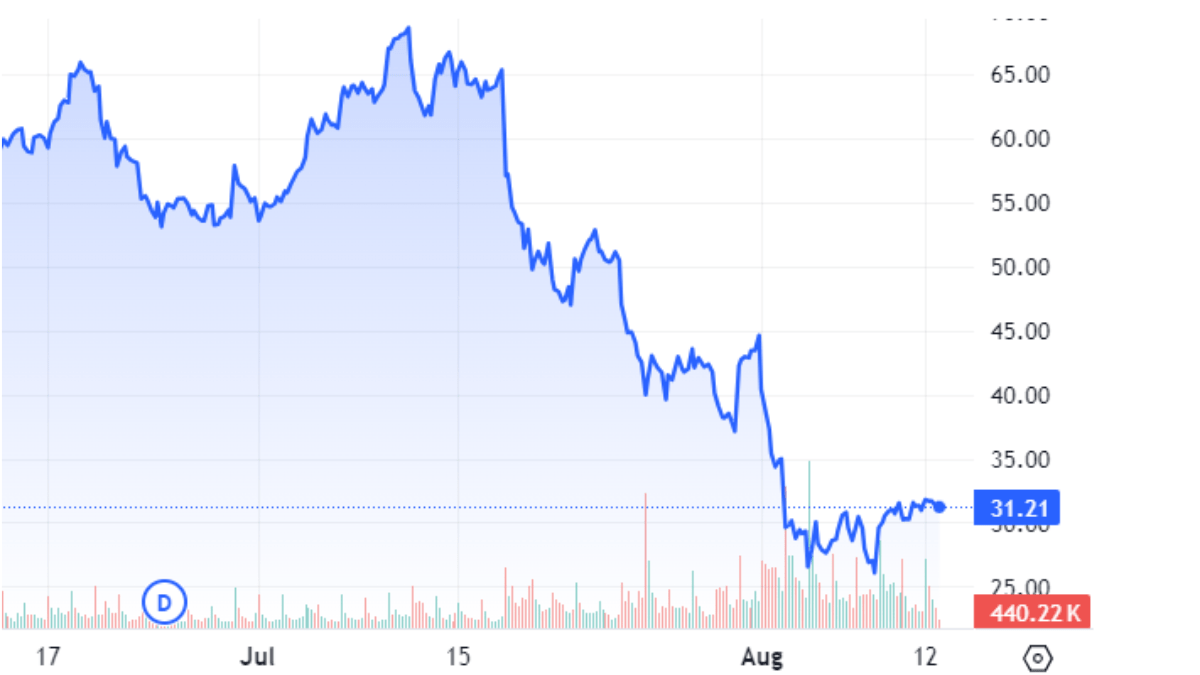

SOXL Stock Performance in 2025

As of April 2025, SOXL is trading at $10.23, reflecting significant volatility:

- Year-to-Date Return: -36.18%.

- 52-Week Range: $8.18–$70.80.

Despite recent declines, analysts predict a potential rebound in the semiconductor sector, driven by increasing demand for AI, 5G, and EV technologies.

SOXL Stock Forecast for 2025

Analysts have mixed predictions for SOXL’s performance in 2025 due to its leveraged nature:

- Short-Term Projections:

- May 2025: Expected average price of $14.74 (+44%).

- September 2025: Projected to hit $139.16 (+1,260%).

- Year-End Forecast:

- Average Price Target: $114.41 (+1,018%).

- High Estimate: $227.82 (+2,128%).

These projections highlight both the high potential rewards and risks associated with SOXL.

Why Invest in SOXL?

Opportunities

- AI and Semiconductor Growth:

- The global adoption of AI, IoT, and quantum computing is driving demand for semiconductors.

- Companies like NVIDIA and AMD are key contributors to this growth.

- High Leverage Potential:

- SOXL offers amplified returns during bullish trends in the semiconductor sector.

- Short-Term Trading Opportunities:

- The ETF’s high volatility makes it ideal for active traders looking to capitalize on market swings.

Risks of Investing in SOXL

- Leverage Decay:

- The daily resetting feature of leveraged ETFs can erode returns over time due to compounding effects.

- Market Volatility:

- Semiconductor stocks are highly sensitive to macroeconomic trends, such as interest rates and inflation.

- Not Suitable for Long-Term Holding:

- Due to leverage decay and market fluctuations, SOXL is not recommended for buy-and-hold investors.

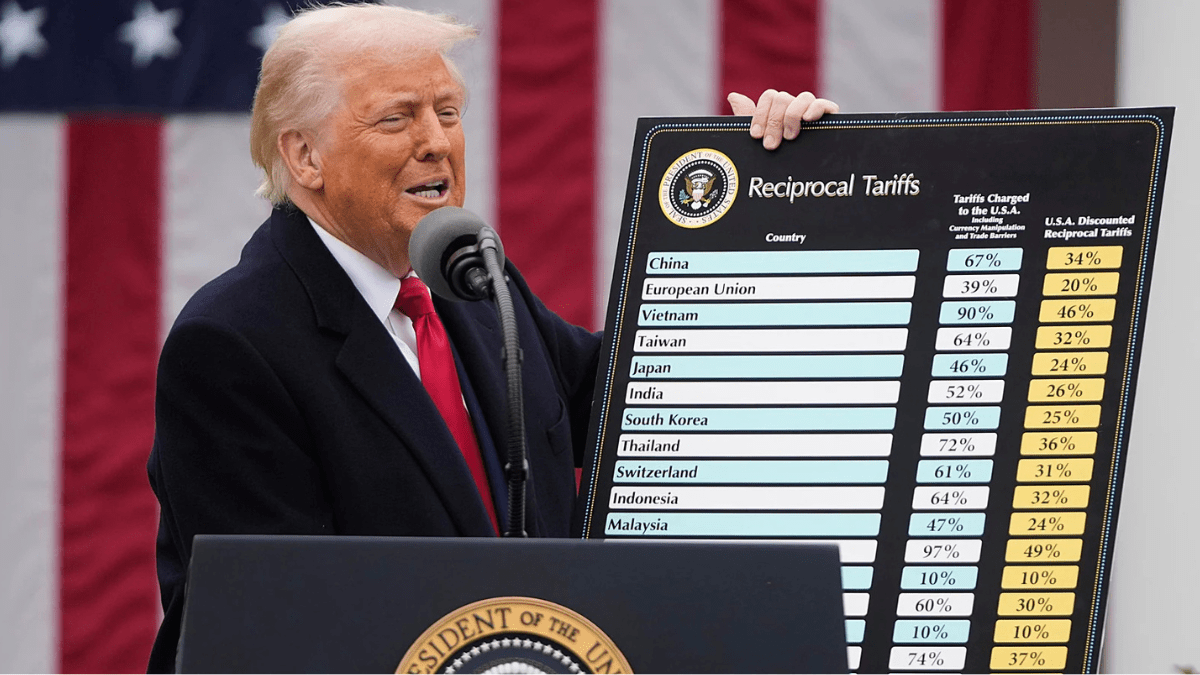

- Regulatory Risks:

- Changes in market regulations or trade policies could impact the semiconductor industry.

Tips for Trading SOXL

- Use stop-loss orders to mitigate risks during volatile periods.

- Monitor semiconductor industry trends closely.

- Limit exposure by allocating only a small portion of your portfolio to leveraged ETFs like SOXL.

Final Thoughts

SOXL offers an exciting opportunity for aggressive investors looking to capitalize on short-term trends in the semiconductor sector. However, its high volatility and leveraged nature make it a risky investment that requires careful monitoring and active management.

0