TSLL Stock: Discover TSLL stock insights for 2025! Learn about its leveraged returns on Tesla, risks, performance trends, and expert trading tips for this high-volatility ETF.

TSLL Stock 2025: Performance, Risks, and Investment Insights

The Direxion Daily TSLA Bull 2X Shares (NASDAQ: TSLL) is a leveraged exchange-traded fund (ETF) designed to amplify Tesla’s daily stock movements by 200%. With high volatility and unique risks, TSLL has gained attention among aggressive investors in 2025. This blog explores its current performance, potential opportunities, and risks.

What is TSLL?

TSLL is a leveraged ETF that seeks to deliver 2x the daily price return of Tesla, Inc. (TSLA), before fees and expenses. It uses derivatives such as swaps to achieve its leverage, making it suitable for short-term tactical trades rather than long-term investments.

Key Features

- Inception Date: August 9, 2022.

- Expense Ratio: 0.95%.

- Assets Under Management (AUM): $4.39 billion.

- Dividend Yield: 4.59%.

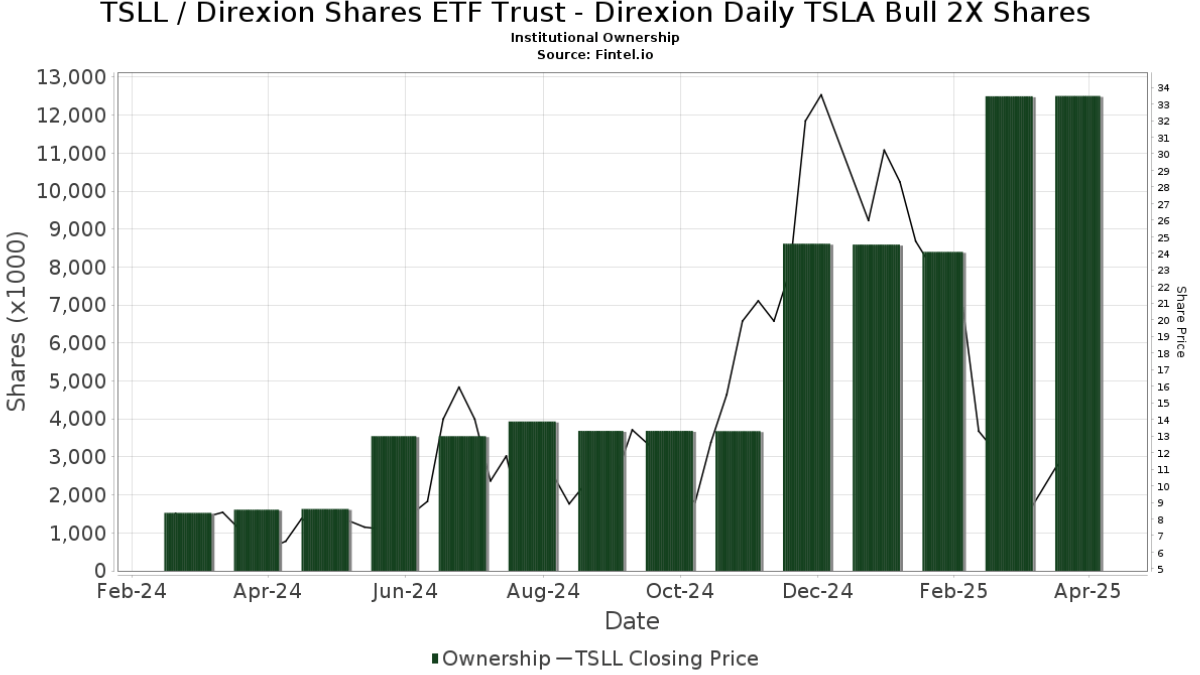

TSLL Stock Performance in 2025

As of April 2025, TSLL’s performance has been highly volatile:

- Year-to-Date Return: -67.28%.

- 1-Year Return: +8.52%.

- All-Time Return: -66.67%.

Price Metrics

- Current Price: $9.20.

- 52-Week Range: $4.94–$18.40.

While TSLL offers the potential for amplified gains during bullish Tesla trends, it also carries significant risks during flat or bearish periods due to the effects of compounding.

Advantages of Investing in TSLL

- High Leverage Potential: Provides an opportunity to achieve double the daily returns of Tesla stock, making it attractive for short-term traders during bullish trends.

- Liquidity: High trading volume ensures ease of entry and exit for active traders.

- Dividend Yield: Offers a dividend yield of 4.59%, adding income potential for investors.

Risks Associated with TSLL

- Volatility and Compounding Risk: Longer holding periods can lead to unpredictable returns due to compounding effects, especially during volatile markets.

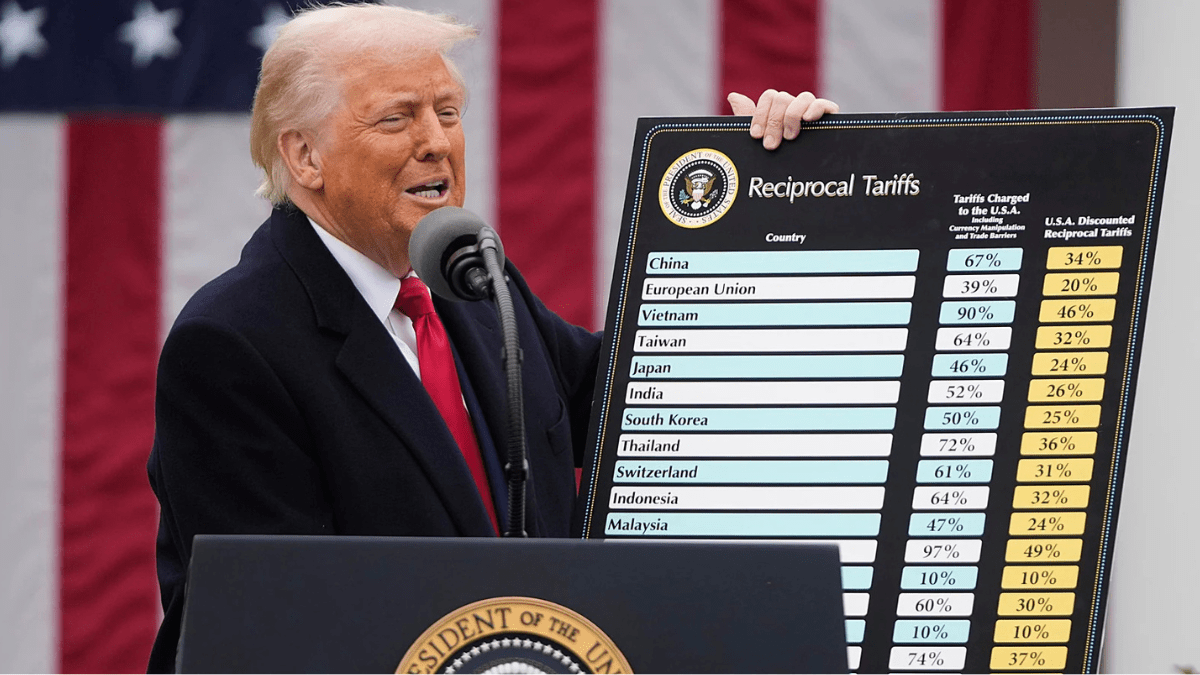

- Lack of Diversification: Unlike traditional ETFs, TSLL tracks only Tesla stock, exposing investors to single-stock risk.

- Not Suitable for Long-Term Holding: The fund’s structure is optimized for daily returns, making it unsuitable for long-term investments.

Who Should Invest in TSLL?

TSLL is ideal for experienced traders who understand leverage risk and actively manage their portfolios on a daily basis. It is not recommended for conservative investors or those seeking long-term exposure to Tesla.

Tips for Trading TSLL

- Monitor Tesla’s stock trends closely before investing in TSLL.

- Use stop-loss orders to mitigate risks during volatile periods.

- Avoid holding positions for extended periods due to compounding effects.

Final Thoughts

TSLL offers an exciting opportunity for traders looking to capitalize on Tesla’s daily price movements with amplified returns. However, its high-risk nature and lack of diversification make it unsuitable for all investors. If you’re considering investing in TSLL, ensure you have a clear strategy and risk management plan.

This blog post is optimized with keywords like TSLL stock, Direxion Daily TSLA Bull ETF, and Tesla leveraged ETF to rank well on search engines and provide valuable insights to readers interested in this unique investment product.